Wespay’s Instant Payments Brief is a series of short articles designed to help members understand the key concepts of the next generation of payment services.

The defining characteristic of an Instant Payment transaction is, of course, the speed with which it clears (i.e., the movement of funds from the sender to the receiver) and settles (the exchange of funds between the sender’s and receiver’s financial institutions).

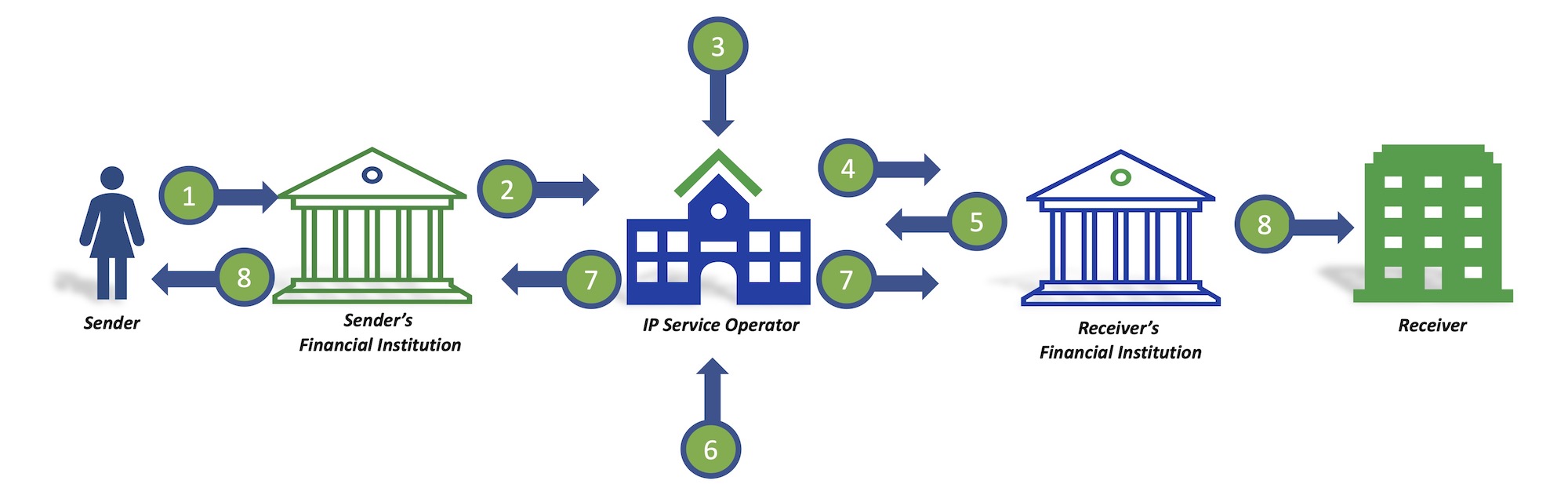

And while the two U.S. Instant Payments networks, FedNow and RTP, are relying upon new technologies to achieve this near real-time speed, the network participants and the overall payments flow of both Instant Payment networks should be recognizable to anyone familiar with the ACH or check network.

The sample processing flow outlines the key steps for both U.S. Instant Payments networks, RTP and FedNow.

* All steps take place in a matter of seconds

© 2023 Wespay Advisors. All rights reserved.